1.2 Thailand overview

Geography

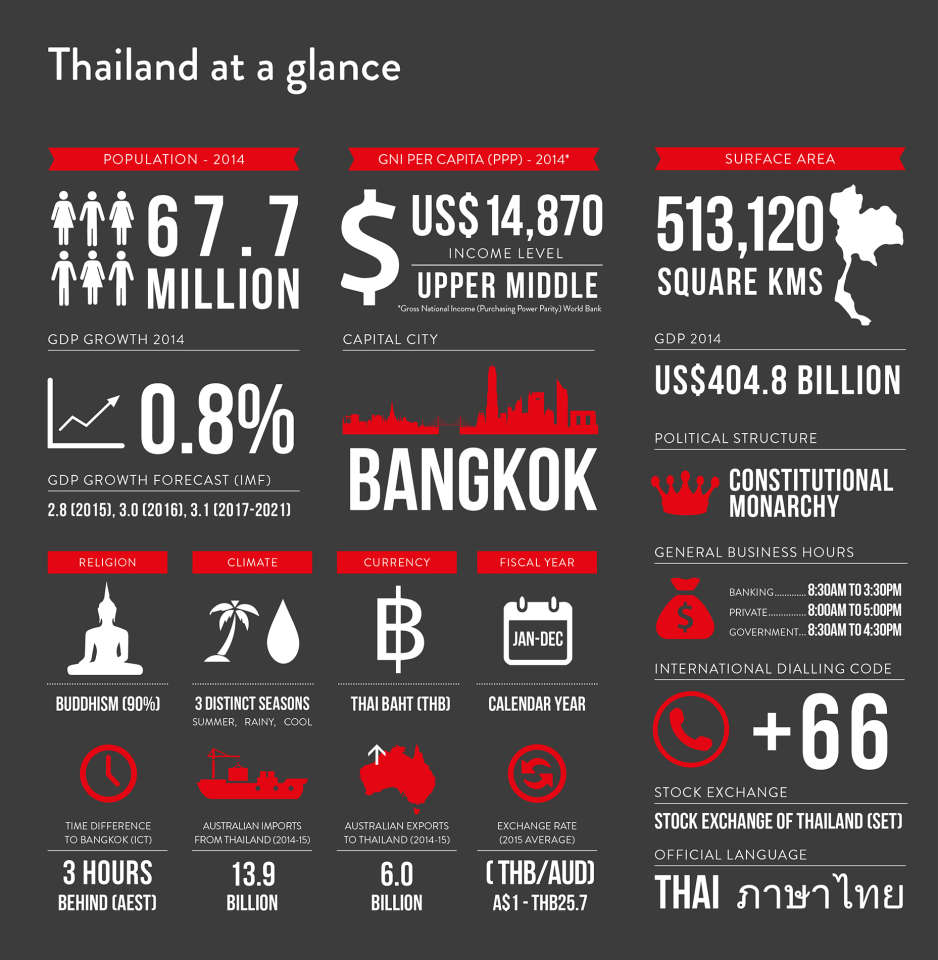

Thailand is situated in Southeast Asia, flanked by the Indian Ocean and the Gulf of Thailand, and covers 513,120 square kilometres. Its climate is tropical with the average temperature around 29o C and humidity usually sitting between 73 and 82 per cent.

Culture

Religion is a core feature of Thai life. While Buddhism is regarded as the national religion, practised by more than 90 per cent of the population, Islam, Christianity, Hinduism and other faiths are also represented. Religious freedom is enshrined in the Thai constitution.

Thailand is a collectivist society, which dictates that the needs of the group are placed ahead of those of the individual. Subtlety and indirect forms of communication are highly valued in Thai society, which is hierarchical. Individuals are viewed as being either higher or lower in status – younger or older, weaker or stronger, junior or senior, subordinate or superior, and rarely equal.

Status can be determined simply by someone's clothing and general appearance, their age or job, education, family history, as well as their wealth and social connections. Status dictates that subordinates will generally listen to and accept direction from superiors without question. Superiors have an unstated obligation to lead and be mentors in return.

Notions of respect and saving face are highly prized. Conflict and angry outbursts are to be avoided at all costs. Differences of opinion and disputes need to be handled delicately and with a smile: no attempt should be made to assign blame. Thais also place great emphasis on the concept of sanuk – the sense that life should be fun and enjoyable.

Politics and government

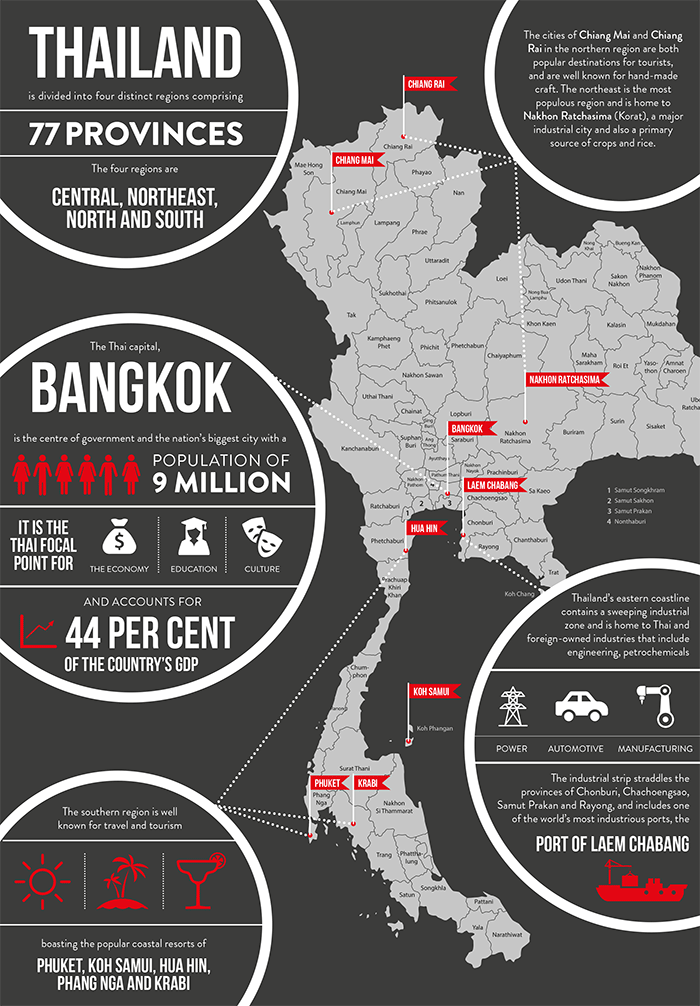

Thailand is a constitutional monarchy. The King exercises his legislative power through the Parliament, executive power through Cabinet and judicial power through the courts. The bicameral Parliament is made up of the House of Representatives and the Senate. Generally, the former consists of 500 members, with 375 of these drawn from single-seat constituencies and a further 125 elected on a party-list basis. Members of the House of Representatives are normally elected for four-year terms; senators get six years at a time. Thailand's 77 provinces are administered by governors (appointed by the Interior Minister), divided into amphurs (districts), tambons (sub-districts) and villages

The current political situation

After political and civil unrest starting in 2005, Thailand's army chief, General Prayuth Chan-ocha, staged a military coup in 2014. While initially clouding the political and economic outlook, the military government has been able to generally restore business confidence, with the Thai economy showing strong signs of recovery.

This has been further strengthened by the new administration's commitment to:

- Free market principles, and further integration with the economies of the Greater Mekong sub-region, ASEAN and Northeast Asia

- The promotion of a value-added, innovation-driven economy

- Upgrading and expanding connectivity and infrastructure

- The launch of digital technology platforms.

The ruling National Council for Peace and Order has introduced an interim constitution, established a National Legislative Council, created a National Reform Council and appointed a provisional civilian-led Cabinet.

Thailand historically has shown economic resilience in the face of political upheaval. Thailand's economy remains export dependent, with exports accounting for more than two-thirds of the country's gross domestic product (GDP), and despite the civil unrest, the military-backed rulers have stayed committed to Thailand's open-door policies.

Economy

Thailand is the second largest economy in the ASEAN region and widely recognised as one of the great development success stories, with a celebrated history of strong and sustained growth paired with impressive poverty reduction. Highlighting this success was the Kingdom's recent shift from a low-income nation to an upper-income nation in less a generation. Thailand's strategic geopolitical position at the centre of the world's fastest growing region will continue to provide unprecedented economic potential as a key leader in promoting regional cooperation and integration going forward.

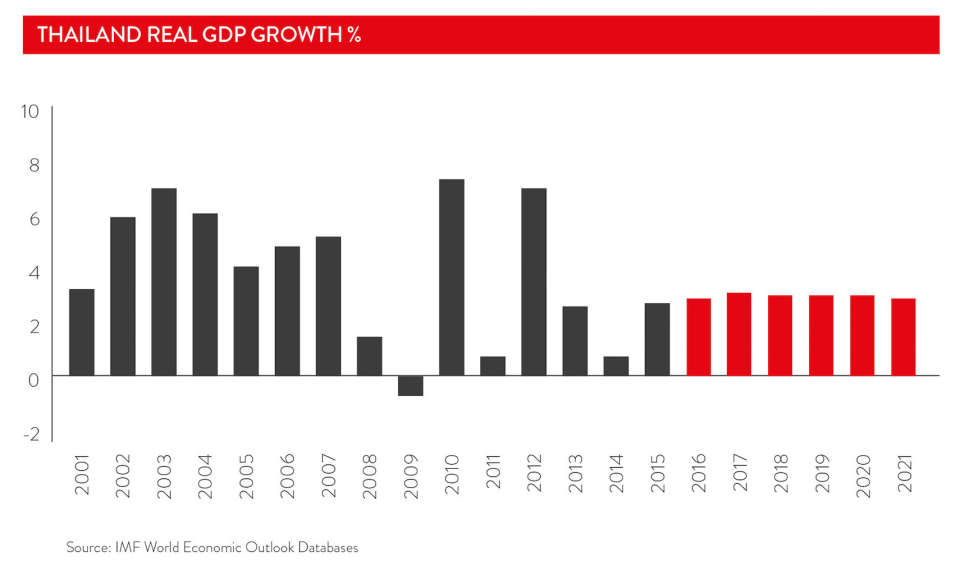

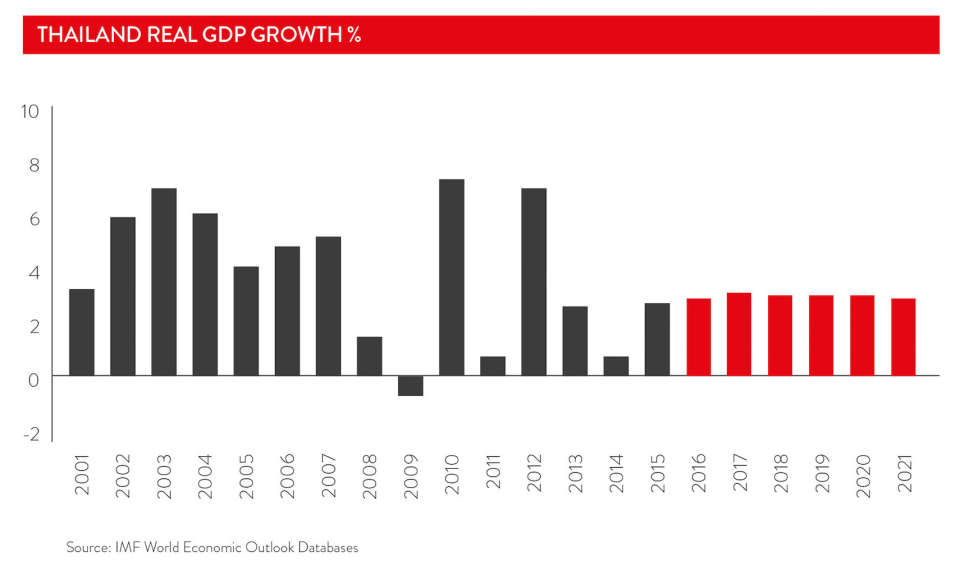

From the 1980s, Thailand enjoyed high economic growth in excess of 8 per cent before the Asian Financial Crisis hit in 1997-1998. After such time, the Kingdom's economic growth has been impeded by a range of factors, most notably global economic shocks, natural disasters and socio-political tensions. However the renowned resilience of Thai people and the Thai economy saw it recover considerably well from the global financial crisis, before severe floods hampered the recovery in 2011 which caused GDP growth to fall from 7.8 per cent in 2010 to 0.1 per cent in 2011.

On the back of a global economic recovery and higher domestic consumption, Thailand's GDP grew 7.3 per cent in 2012. Since this time though, growth has continued to be constrained by cautious private consumption stemming from high household debt, weak merchandise exports due to a decline in competitiveness to low cost emerging regional economies, and the sluggish recovery of the tourism sector following seven months of prolonged political protests in 2013-14. Thailand's economy expanded by only 0.9 percent in 2014, but the IMF forecasts a rise to 3.2 per cent by 2017.

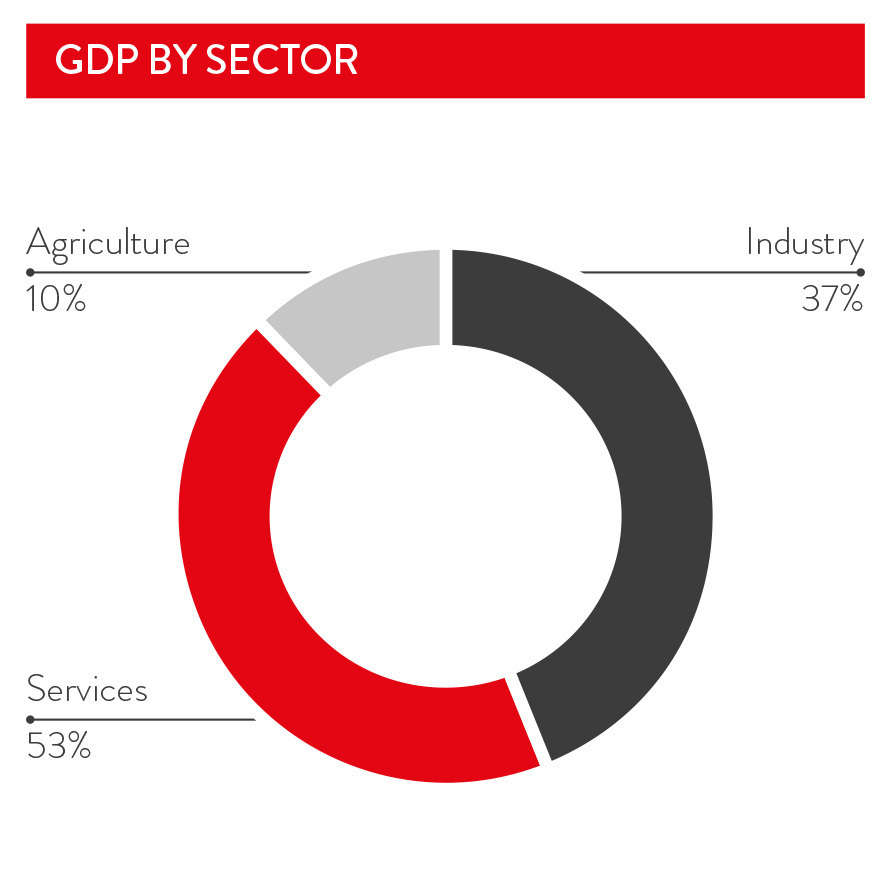

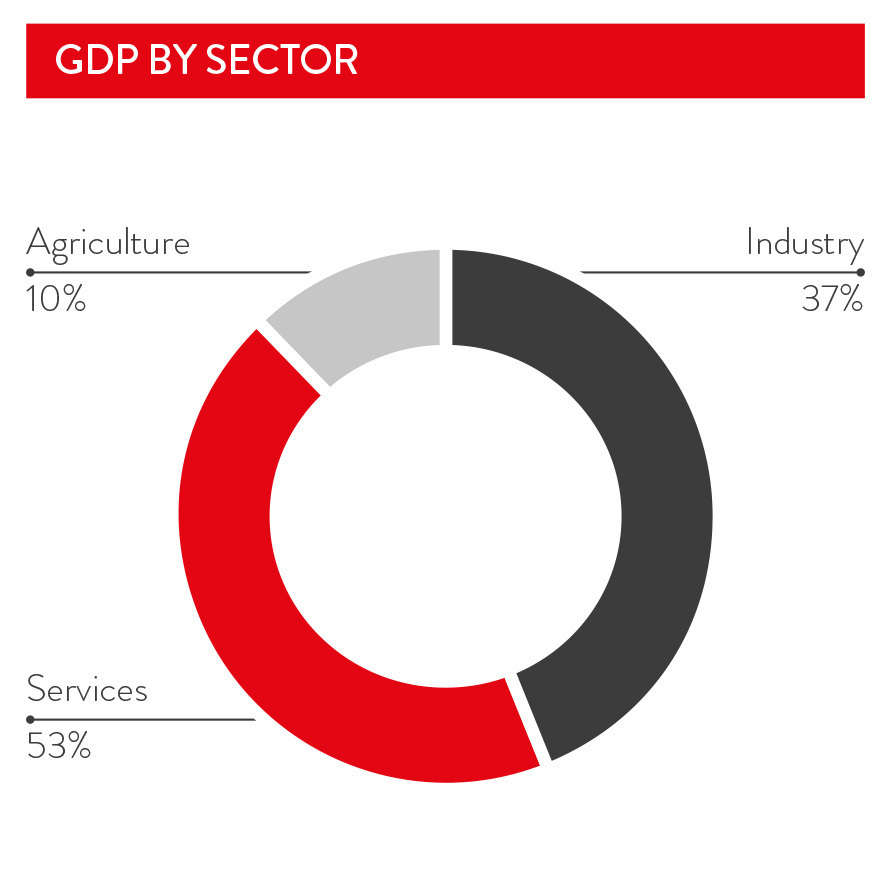

The Thai economy, as it has for decades, continues to be characterised as heavily export-dependent, with exports contributing more than two-thirds to total GDP. A breakdown at the industry level shows that the services and manufacturing industries account for almost 90% of total economic output. While in terms of the local labour force, over one-third are employed in the agriculture industry, followed by manufacturing, wholesale/ retail and construction which are prominent employers.

Uniquely, tourism in Thailand has traditionally accounted for a larger proportion of its economy than any other Asian nation.

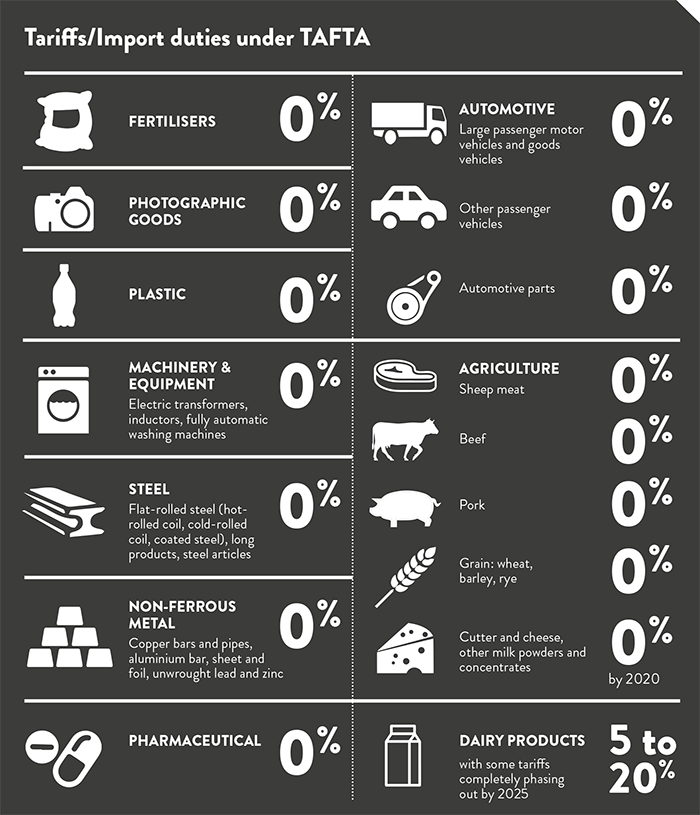

Other major industries include automobiles and automotive parts, electric appliances and components, medical tourism, textiles and garments, agricultural processing (rice, rubber, corn, sugarcane), beverages, cement and other light manufacturing.

Legal system

Thailand has an independent judiciary with a legal system combining the principles of traditional Thai and Western laws. The courts can be divided into civil, criminal, municipal and provincial. Judges are appointed or removed by the King, based on the recommendations of the Judicial Commission. There are no juries in Thailand. The decisions of the Supreme Court are highly authoritative but do not establish binding principles of law. Specialist courts deal with labour, tax, bankruptcy, intellectual property, international trade and administrative matters.

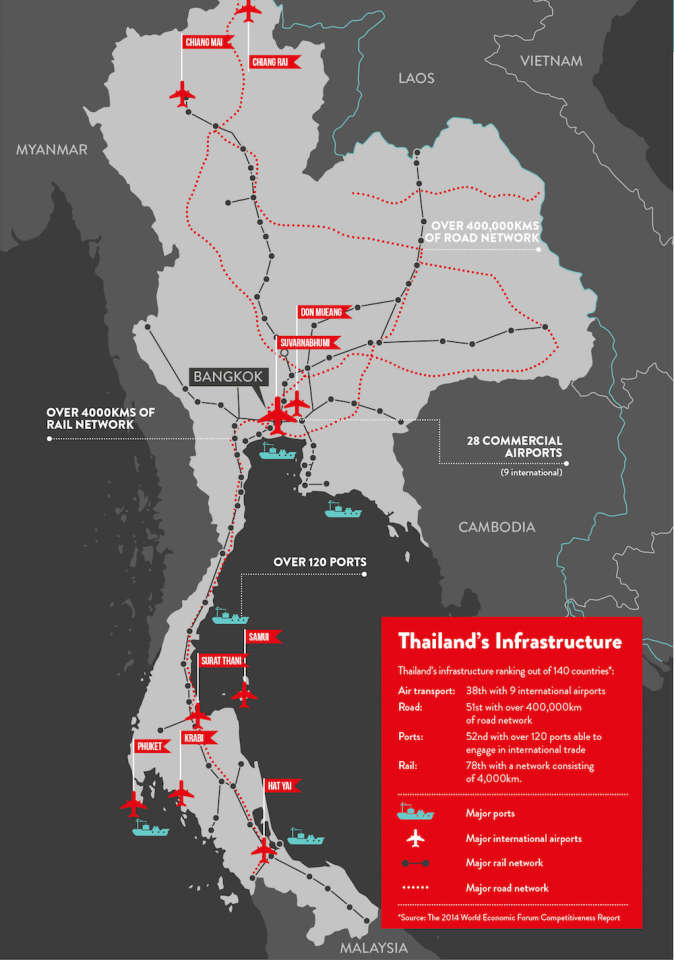

Infrastructure

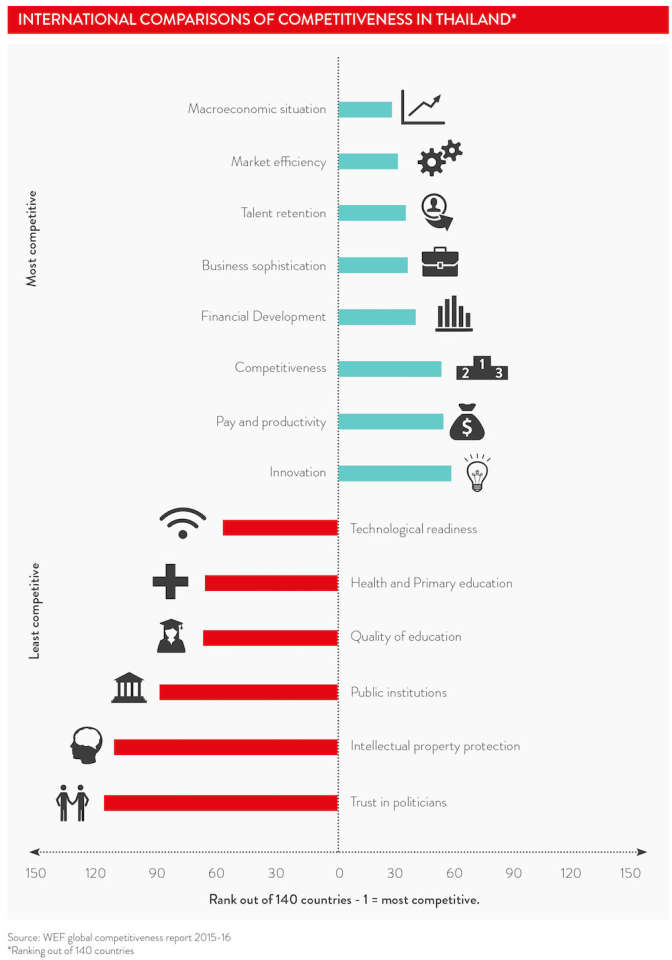

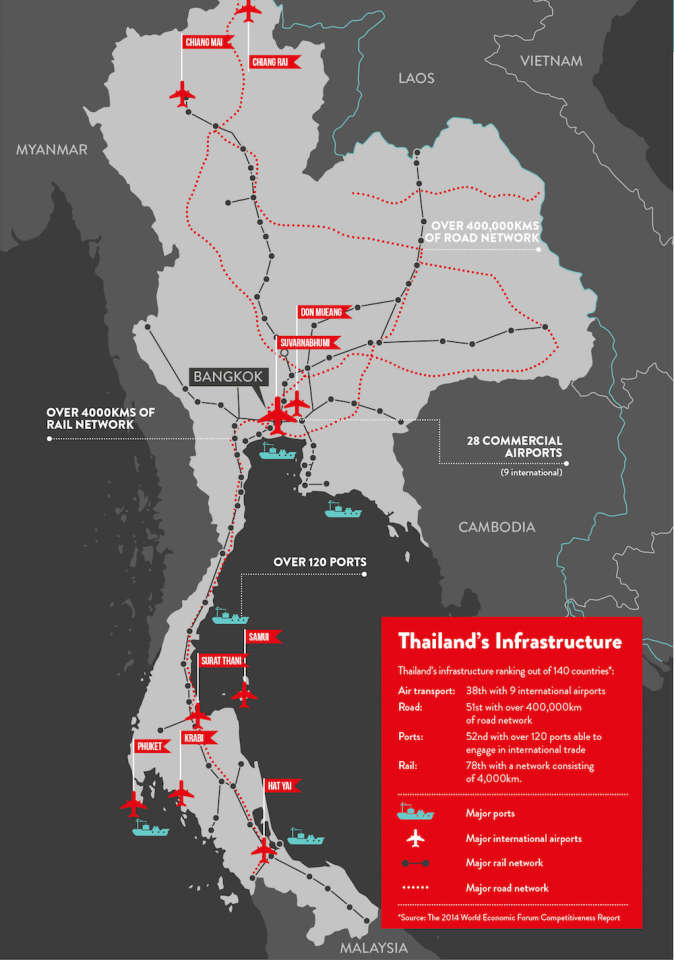

Thailand's spending on infrastructure has lagged behind some regional neighbours. Rankings issued by the World Economic Forum underscore the degree of difficulty: out of 140 countries, it placed Thailand's road network 51st, rail 78th and port infrastructure 52nd. Thailand's air transport infrastructure comes in at 38th place.

The Thai Government is working towards a major infrastructure overhaul, with 20 priority projects across rail, road, air and port. The blueprint estimates a total worth of THB 1.8 trillion in infrastructure and is set for completion by 2022.

Roads: Thailand has an extensive road network of approximately 400,000 kilometres, most of which is paved. National highways connecting the regions, provinces and districts are well maintained and adequate for long-haul transportation.

Sea ports: More than 120 ports accommodate sea-going vessels engaging in international trade. Deep sea ports are located in Bangkok, Laem Chabang and Map Ta Phut on Thailand's eastern seaboard, while Songkhla, Satun, Narathiwat, Phuket and Ranong are in the south.

Rail and mass transit systems: Thailand's rail transportation covers more than 4000 kilometres. Three mass transit systems have been developed in Bangkok, totalling 85 kilometres. The first system, known as the Skytrain, opened in 1999 and operates on overhead tracks. A second system, which opened in 2004, is a subway. A dedicated overhead line from the city to Suvarnabhumi Airport opened in 2011.

Airports: Thailand has an extensive air transport network encompassing 28 commercial airports, of which nine are international. Bangkok is a major hub for air services in the region.

Telecommunications: Fixed line telephones, mobile phones and access to the internet are readily available. However, while the overall penetration of broadband connections remains quite low, the growth rate is accelerating. Ninety-eight per cent of Thais own a mobile phone. The Thai internet market continues to expand, but despite this, the country's estimated personal computer penetration rate remained at 34.9 percent in 2014. Most importantly, with 3G and 4G services being rolled out in a significant way, mobile broadband is booming.

For more information, access the full Thailand Country Starter Pack